Branch Archetypes (2018)

The context:

As part of the Omni-channel Design team (new team, focused on Service Design), our first brief was how to optimise the bank branches. It’s a big question and we needed to break it down. We chose one question to answer:

Why are customers STILL going into a bank branch when there are other channels to use?

Despite investment in apps, online banking, and increasingly feature-rich ATMs, customers still flock into the branch daily.

This behaviour complicates the strategy of the bank to onboard users to digital channels, and free up branch staff to do channel-appropriate work (advice, etc.)

The process:

The team went into different branches across the city and asked customers who were in the branch, what they were there for, and why they came to the branch (as opposed to any other channel).

We had to eliminate the customers who could not have accomplished their task on other channels (while noting those reasons and forwarding the ratios to the relevant teams).

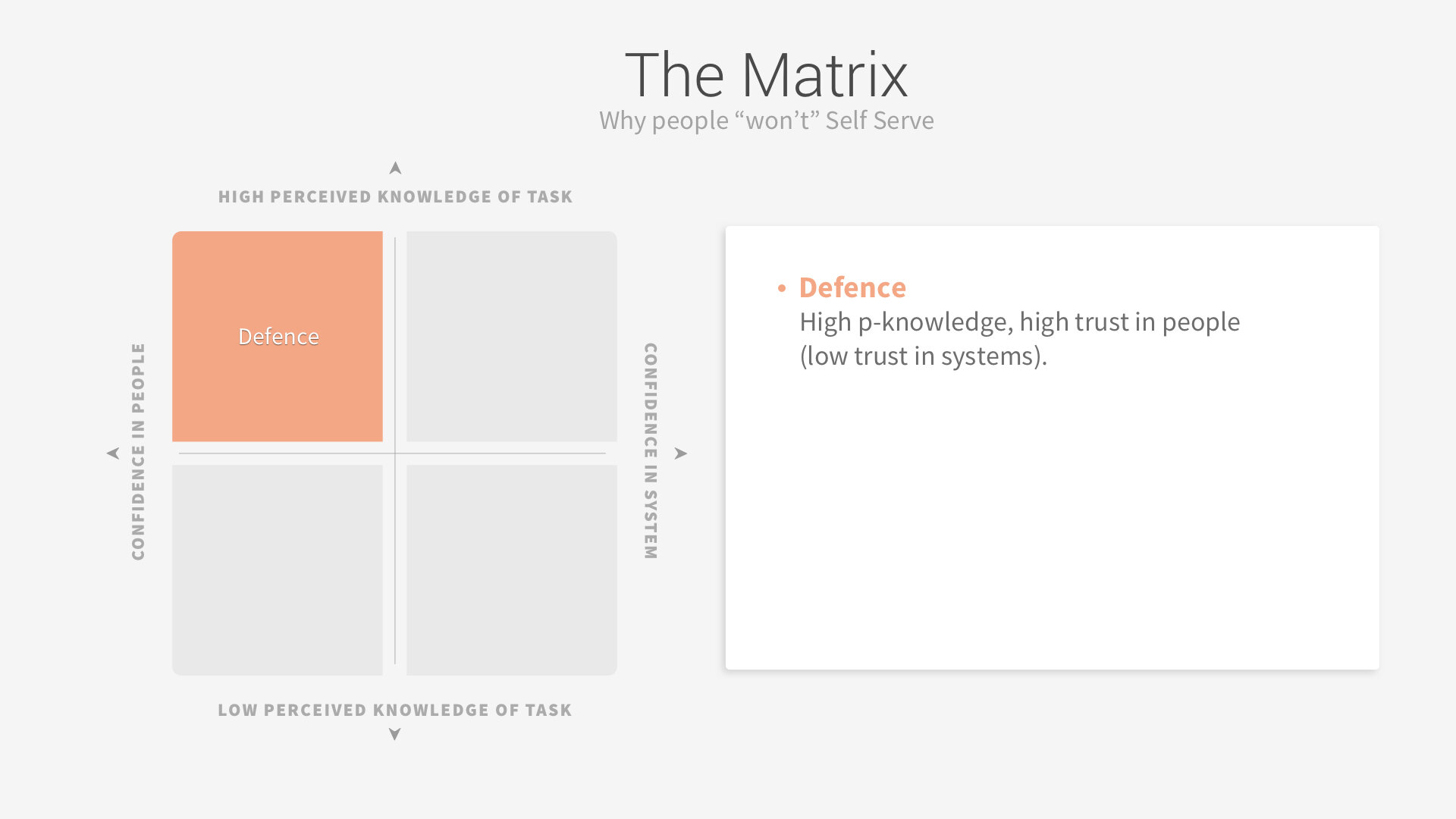

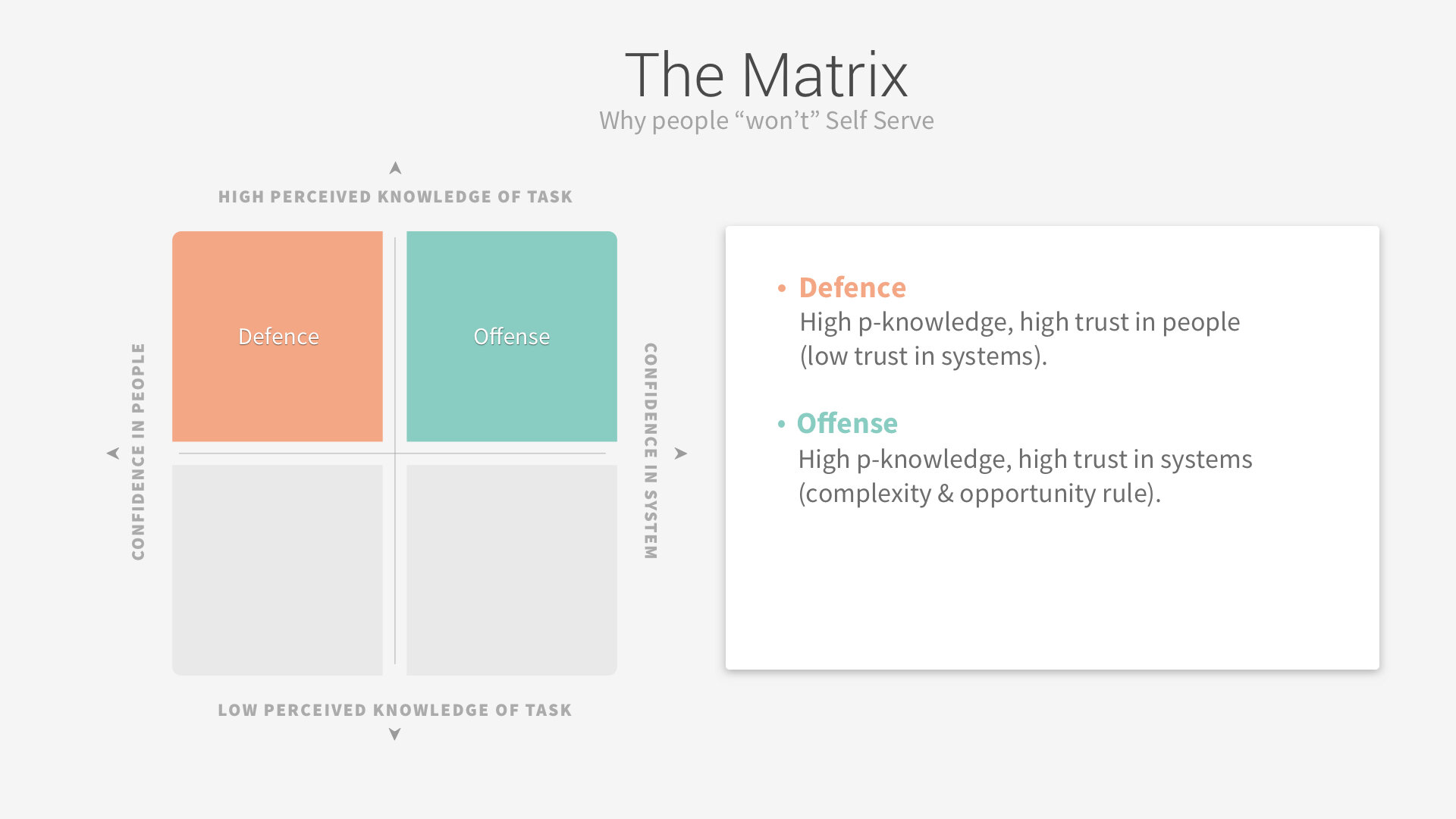

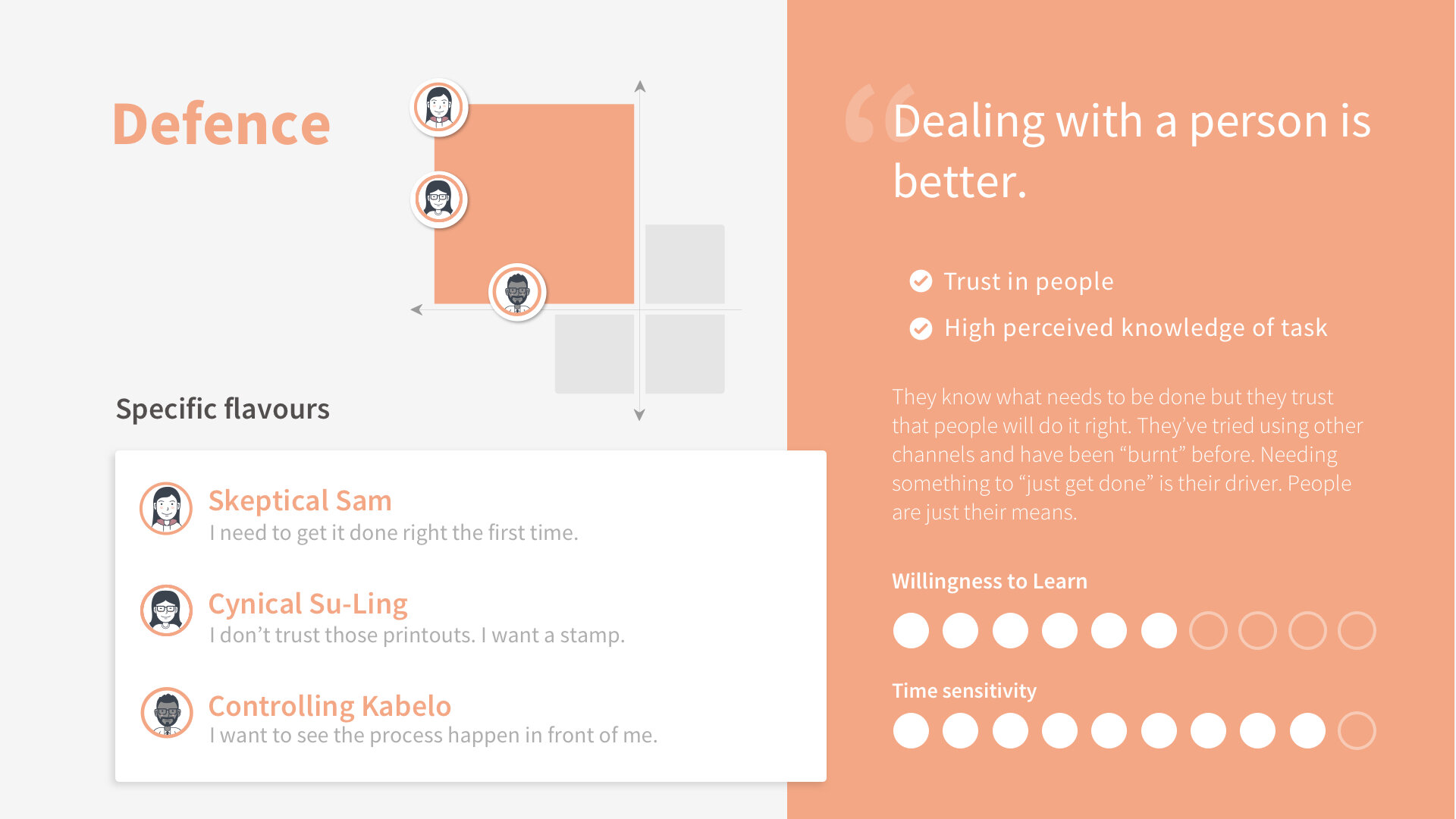

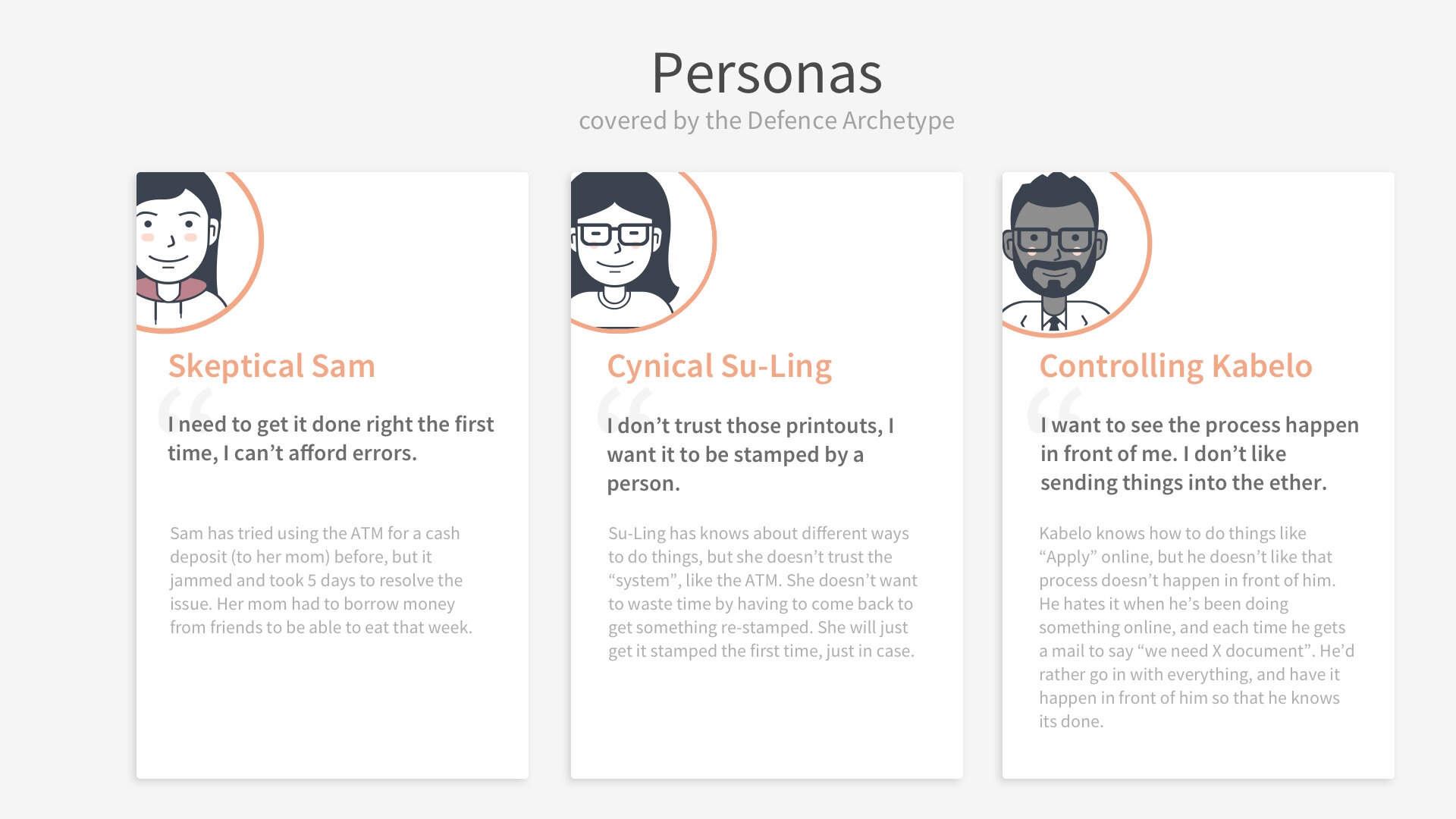

The data emerged naturally: first through behavioural themes (archetypes) then through motivation themes (personas).

The archetypes were mapped against a matrix, the personas were fleshed out as much as possible, and then we went back into the branches to repeat the exercise so that we could validate them.

The results:

A few teams in the bank had been "trying to crack" this work - find out why we had such long branch queues. Nobody had found the right answers. My team and I managed to solve a big problem for the bank; not just by producing archetypes and personas, but because they can now be used (and have been) for all Branch initiatives. Currently, they're being used to:

Design account opening and upgrade experiences in branch (with provisions for each archetype)

Provide empathy training for staff members

Guiding signage and extra collateral in branches

The work has been shared all the way up to the Executive level of the bank. This simple piece of work will help the bank see their customers as human, with relatable motivations and personalities for a while to come.

My contribution

I led this piece of work.

I ran the research, analysed the results, formulated hypothetical archetypes and personas, and then validated them with more testing.

I’m incredibly proud of this work.

What I enjoyed:

Starting with a “problem” rather than a solution

The research was the objective, rather than just a part of the project

Solving a problem that nobody else had

What I struggled with:

Having to move on quite soon after it was done, instead of being able to tweak and tinker with the results (with more testing)

The potential misuse of the results - it was a specific insight about a specific problem and the danger was that the bank would appropriate it incorrectly

Tools I used:

User research

User testing

Contextual enquiry